Are You Truly Prepared?

For many Credit Union leaders, navigating the intricacies of advanced IT risk, security and resilience requirements can create a significant "governance gap." How can you confidently ensure your Credit Union is protected and compliant in an increasingly digital threat landscape?

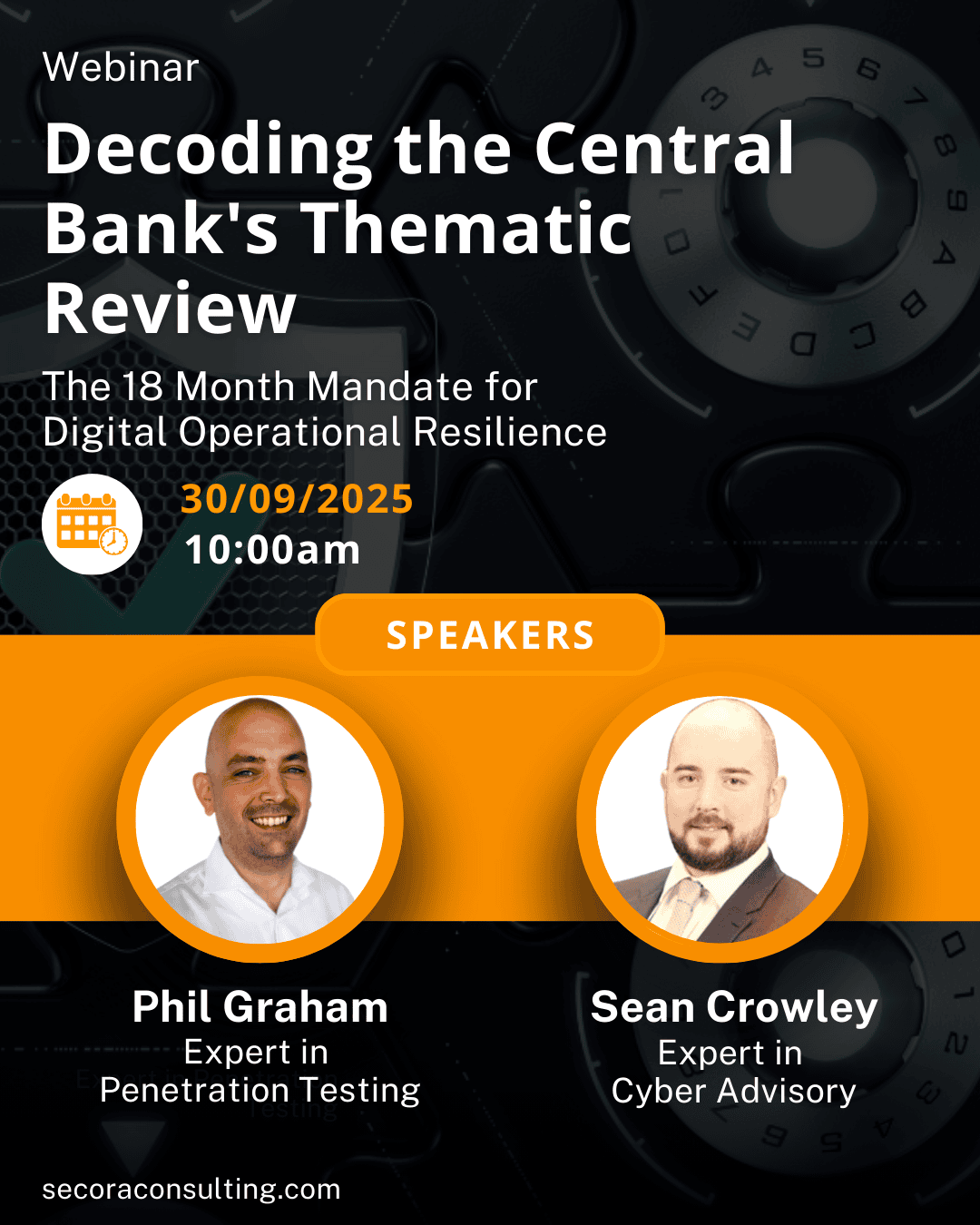

Join our exclusive webinar to get the clarity and confidence you need to meet this mandate head-on.